Global E-Commerce Marketplaces: Models, Risks, and Opportunities

A deep dive into global digital marketplace platforms, supplier dynamics, revenue models, and how they are transforming modern commerce.

Global Marketplace Platforms: Business Models, Supplier Dynamics, and the Future of Digital Commerce

World Biz Magazine - Business & Economy Desk

Category: Platform Economy

Date: January 22, 2026

The Rise of Digital Marketplaces: A Trillion-Dollar Frontier

Over the past two decades, digital marketplace platforms have evolved from simple listing directories into the backbone of global commerce. Today, these platforms facilitate more than $38.5 trillion in combined B2B and B2C trade. For modern enterprises, the digital marketplace is no longer a peripheral sales channel; it is a strategic infrastructure that dictates market reach, operational agility, and capital flow.

As we move toward 2030, the distinction between "online" and "offline" commerce has blurred. Marketplaces now manage everything from complex cross-border logistics to AI-driven customer journeys, creating a high-stakes environment where understanding platform mechanics is essential for survival.

Market Size and Analysis: The Dominance of B2B

While B2C platforms like Amazon and eBay capture the public imagination, the true scale of digital commerce lies in the Business-to-Business (B2B) sector.

· Growth Projections: Global B2B e-commerce sales reached approximately $28.1 trillion in 2024 and are projected to soar to $62.2 trillion by 2030, representing a CAGR of 14.5%.

· The B2B vs. B2C Gap: In 2025, B2B market value exceeded B2C by over 400%. This dominance is driven by high average order values (AOV) and the digitalization of legacy industries such as manufacturing, chemicals, and medical supply.

· Market Concentration: A few "super-platforms" (Alibaba, Amazon, JD.com) control the majority of global traffic, yet specialized vertical marketplaces are gaining ground by offering tailored industry compliance and technical specifications.

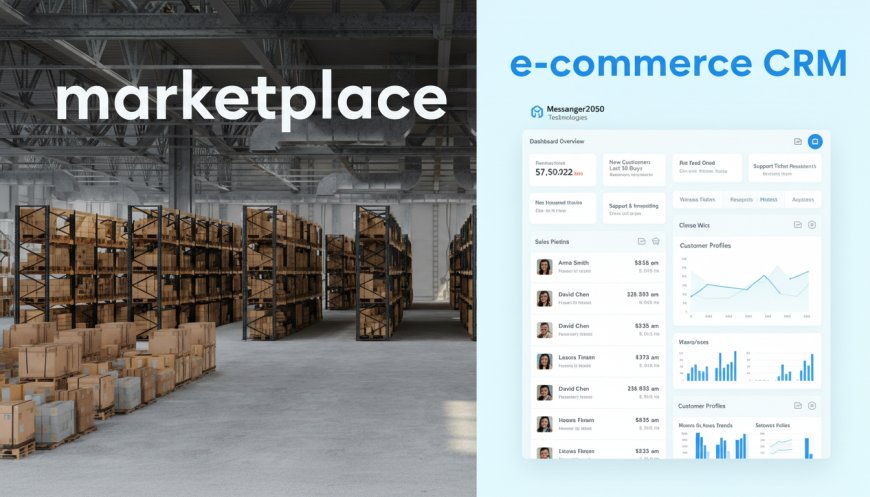

The Technological Engine: IT, CRM, and Warehouse Intelligence

The "Global Marketplace" is increasingly a software-defined entity. Technology has shifted from being a supporting tool to the core value proposition of these platforms.

1. AI-Powered CRM and Hyper-Personalization

Modern Customer Relationship Management (CRM) systems integrated with AI have transformed how platforms interact with users.

· Predictive Analytics: AI-driven CRMs analyze billions of data points to forecast buyer intent, reducing customer acquisition costs (CAC) by up to 20%.

· Automated Engagement: Platforms utilize "Conversational AI" to handle 24/7 customer support, lead scoring, and personalized re-engagement campaigns without human intervention.

· SME Empowerment: Integrated CRM tools allow small businesses on these platforms to access enterprise-level data insights, leveling the playing field against larger competitors.

2. Smart Warehousing and IT-Led Logistics

Marketplace leaders are no longer just software companies; they are robotics and data-logistics giants.

· Automation & Robotics: Smart warehouses now utilize Autonomous Mobile Robots (AMRs) and Automated Storage and Retrieval Systems (ASRS). According to industry data, logistics automation can cut operational costs by up to 30% while improving delivery speed by 25%.

· Digital Twin Technology: Marketplaces use digital twins to simulate warehouse flows and supply chain disruptions in real-time, allowing for "just-in-time" inventory management that minimizes capital tied up in stock.

· The Role of IoT: Internet of Things (IoT) sensors provide end-to-end visibility, tracking temperature, humidity, and location for high-value B2B components or perishable B2C goods.

Core Business Models & Supplier Dynamics

The relationship between a platform and its suppliers is defined by the underlying economic model.

|

Model Type |

Primary Examples |

Supplier Autonomy |

Revenue Drivers |

|

Infrastructure (Open) |

Alibaba.com, eBay |

High: Suppliers set terms and prices. |

Advertising, Subscriptions |

|

Retail-Driven (Hybrid) |

Amazon, JD.com |

Low: Strict compliance and fee structures. |

Commissions, Logistics Fees |

|

Vertical/Niche |

Etsy, ThomasNet |

Moderate: High trust, specific standards. |

Listing fees, Premium services |

Payment Cycles & Fintech Integration

· Embedded Finance: Many platforms now offer their own credit lines, insurance, and escrow services.

· Blockchain & Smart Contracts: In B2B trade, blockchain-based smart contracts are replacing traditional Letters of Credit, triggering instant payments once IoT sensors verify delivery.

· Predictability: While retail-driven platforms enforce fixed biweekly payout cycles, B2B platforms often allow for negotiated milestones (e.g., 30% upfront, 70% on delivery).

Future Trends: What’s Next for Global Commerce?

1. Logistics-as-a-Service (LaaS): Marketplaces will increasingly monetize their proprietary logistics networks, offering fulfillment services even for sales made off-platform.

2. Regulatory Scrutiny: As platforms gain immense power over data and pricing, global antitrust and data privacy regulations (e.g., GDPR, DMA) will force greater transparency in algorithmic ranking.

3. Sustainability Tech: Future platforms will integrate "Carbon Tracking" software, allowing buyers to choose suppliers based on the environmental footprint of their manufacturing and shipping routes.

Conclusion: A Strategic Imperative

Digital marketplaces have matured into complex ecosystems where IT sophistication is as vital as product quality. For businesses, success depends on a dual-track strategy: leveraging the massive scale of horizontal giants like Amazon or Alibaba while maintaining a presence on specialized, high-trust niche platforms.

As AI, robotics, and fintech continue to merge, the stakeholders who master these technological levers will define the next era of global trade.

Disclaimer: This article is published by World Biz Magazine for informational purposes. It does not constitute legal, financial, or commercial advice. Readers should conduct their own due diligence before making strategic investments.

What's Your Reaction?

Like

1

Like

1

Dislike

0

Dislike

0

Love

1

Love

1

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

1

Wow

1