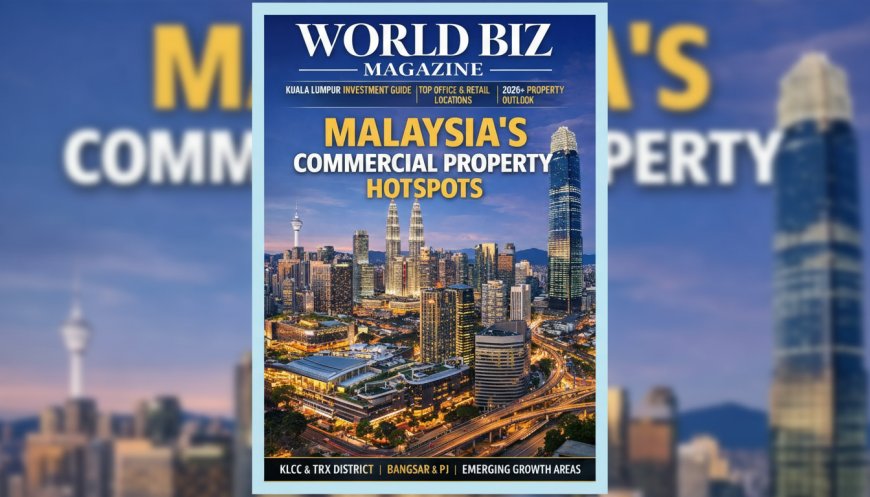

Malaysia Commercial Real Estate Market: Best Areas to Invest in Kuala Lumpur (2026–2035 Outlook)

A detailed guide to Malaysia’s commercial property market, highlighting top investment areas in Kuala Lumpur and future growth outlook beyond 2026.

Malaysia’s Commercial Real Estate Market: Past Performance, Current Trends & Future Outlook

World Biz Magazine | Global Real Estate Insights

Office Sector: Stabilising but Transforming

Historical Context

After the pandemic, Malaysia’s office market experienced subdued demand as hybrid work reduced occupier footprints and surplus space grew, especially in older buildings. Vacancy rates in Kuala Lumpur reached elevated levels as tenants migrated toward newer, better-equipped premises.

Current Dynamics

Today, the office market is showing signs of stabilization:

- Flight to quality: Tenants are increasingly choosing Grade A offices that offer modern amenities, ESG-compliance and strategic locations close to transit.

- Hybrid work: While remote work dampened demand previously, a return to office trend is emerging, with suburban locations seeing uptake as commuters prioritise shorter travel times.

- Older stock pressure: Legacy Grade B and C buildings are struggling to retain tenants without major refurbishments or repositioning.

Future Outlook

Looking forward into 2026 and beyond:

- Sustainability is non-negotiable: ESG and green certifications will be baseline criteria in new developments. Older assets that fail to meet these standards risk obsolescence.

- Moderate rent growth: Limited new supply of high-quality office space and firm occupier preferences should support measured rental increases, although structural oversupply in certain segments may persist.

- Mixed-use integration: Offices within integrated developments that combine retail, lifestyle and transit access will likely outperform standalone towers.

Co-Working & Flexible Spaces: Riding the Hybrid Wave

Emerging Trends

Co-working and flexible office space providers have gained traction as businesses seek adaptable lease terms and cost efficiencies amid uncertain economic cycles. According to pre-2025 analyses, flexible workspaces were anticipated to grow strongly due to hybrid work models and startup/SME demand, with uptake around 20% annually.

Role in the Broader Market

These spaces are becoming strategic for landlords and developers:

- Demand buffer: They help absorb smaller occupiers that might otherwise be priced out of traditional offices.

- Innovation hubs: Co-working centres often attract startups, tech firms, and creative enterprises, increasing vibrancy in urban cores.

- Lease flexibility: Shorter, scalable leases make co-working appealing in uncertain economic conditions.

Outlook

Going into 2026, flexible spaces are expected to expand, particularly in emerging urban centres and transit-oriented districts where accessibility and lifestyle integration are key. These spaces may also become part of larger mixed-use developments that blur the lines between commercial workplace, retail and leisure.

Retail Sector: Resilient and Evolving

Recovery Trajectory

Retail property has shown resilience compared with office assets, driven by:

- Consumer spending recovery: Domestic consumption and tourism inflows support malls and experiential formats.

- Shoplots & neighbourhood retail strength: Smaller, community-oriented retail units remain actively transacted due to stable footfall and SME demand.

Even with global retail sector disruptions, Malaysia’s prime shopping complexes maintained strong occupancy and rental performance through 2025.

Structural Shifts

Retail is evolving from traditional product-centric formats to “retailtainment” blending entertainment, food & beverage, and lifestyle experiences reflecting changing consumer preferences.

Looking Ahead

- Experience-led retail: Landlords will continue integrating entertainment, cultural events, and digital engagement to drive footfall.

- Mixed-use synergies: Retail components in integrated townships and transit-oriented developments will capture weekday and weekend traffic.

- Tourism impact: Events like “Visit Malaysia 2026” are expected to boost foot traffic and spending in retail destinations.

Market Size & Investment Outlook

Market research projects sustained growth in the commercial real estate sector:

- Commercial real estate value in Malaysia is forecast to grow from around USD 10.28 billion in 2026 to USD 14.78 billion by 2031, at an approximate 7.55 % CAGR across the period.

- Offices are expected to retain the largest share, while data-centre-oriented industrial parks and logistics properties are rising rapidly as complementary commercial asset classes.

This underscores broad interest from institutional capital, especially in high-quality, well-connected assets.

Key Growth Drivers & Structural Themes

- Infrastructure Development

Major rail links, transit systems, and special economic zones (e.g., Johor-Singapore SEZ) are reshaping land values and tenant preferences toward well-connected precincts. - ESG & Quality Focus

Sustainability now underpins asset competitiveness; green certifications and efficient operations are vital. - Foreign Investment & Trade Linkages

Trade agreements and FDI flows are bolstering demand in commercial and industrial real estate. - Demographic & Work Trends

Urbanisation, hybrid work models and rising entrepreneurial activity fuel demand for flexible offices and community-centric retail.

Malaysia’s Commercial Real Estate Market:

Where to Invest in Kuala Lumpur & Key Growth Regions (2026 Onwards Outlook)**

Malaysia’s commercial real estate market is entering a new strategic phase. After years of adjustment following the pandemic, the sector is no longer driven by volume expansion alone, but by location quality, infrastructure connectivity, sustainability, and tenant resilience. For investors, the critical question is no longer whether to invest, but where and in which commercial segment.

This article examines Malaysia’s top commercial real estate investment areas, with a special focus on Kuala Lumpur, and provides forward-looking assumptions from 2026 onwards across offices, retail, and co-working spaces.

Macro Overview: Malaysia Commercial Property Landscape

Malaysia remains one of Southeast Asia’s most attractive commercial property markets due to:

· Political and regulatory stability

· Strategic ASEAN trade positioning

· Competitive property pricing versus Singapore

· Strong infrastructure pipeline

· Growing middle-income population and urbanisation

While oversupply exists in select office segments, prime locations and mixed-use developments continue to outperform. The investment cycle is now highly selective rather than speculative.

Kuala Lumpur: Core Investment Zones

Kuala Lumpur remains the epicentre of Malaysia’s commercial real estate activity. However, performance varies significantly by micro-location.

Kuala Lumpur City Centre (KLCC)

Best for: Grade-A Offices | Luxury Retail | Mixed-Use Assets

KLCC remains Malaysia’s most prestigious commercial address and a magnet for:

· Multinational corporations

· Financial institutions

· Embassies and regional headquarters

Why Invest

· Strong demand for premium, ESG-compliant office towers

· Stable rental yields despite higher entry prices

· High resilience during economic downturns

2026+ Outlook

KLCC will remain a capital-preservation zone, with moderate rental growth driven by limited new supply and ongoing flight-to-quality trends.

Tun Razak Exchange (TRX)

Best for: Financial Offices | Mixed-Use Commercial

TRX is Malaysia’s first purpose-built international financial district and one of the most important long-term investment zones.

Why Invest

· Home to global banks, fintech firms, and institutional tenants

· Integrated with MRT lines and lifestyle components

· Government-backed master planning reduces execution risk

2026+ Outlook

TRX is expected to mature into Malaysia’s financial core, with rising occupancy and strong investor interest in commercial strata and REIT-backed assets.

Bangsar & Mid Valley Corridor

Best for: Corporate Offices | Co-Working | Retail Offices

This corridor has evolved into a high-demand business-lifestyle hub, favoured by tech firms, media companies, and regional offices.

Why Invest

· Excellent connectivity and affluent catchment

· Strong demand for flexible office layouts

· Retail-office integration increases footfall and asset resilience

2026+ Outlook

Bangsar and Mid Valley will remain top performers for rental stability, especially for co-working operators and boutique office investors.

Petaling Jaya (PJ)

Best for: Cost-Efficient Offices | SME Hubs | Business Parks

Petaling Jaya is increasingly attracting tenants relocating from central KL to manage costs without sacrificing accessibility.

Why Invest

· Lower acquisition costs than KLCC

· High absorption among SMEs and local corporates

· Growing demand for refurbished Grade-B offices

2026+ Outlook

PJ is expected to benefit from decentralisation trends, offering solid yields for investors willing to reposition older assets.

Retail Commercial Investment Hotspots

Bukit Bintang

Best for: Flagship Retail | Tourism-Driven Assets

Bukit Bintang remains Malaysia’s most active retail and entertainment district.

Why Invest

· High tourist footfall

· Strong performance of experiential retail and F&B

· Anchor malls maintain high occupancy

2026+ Outlook

Retail assets linked to tourism, entertainment, and lifestyle experiences are expected to outperform traditional retail formats.

Suburban & Neighbourhood Retail (PJ, Shah Alam, Puchong)

Best for: Shoplots | Community Retail

Community-centric retail has proven highly resilient.

Why Invest

· Stable cash flow from essential services

· Strong SME demand

· Lower volatility than central malls

2026+ Outlook

Neighbourhood retail will remain a defensive investment, particularly in densely populated suburbs.

Co-Working & Flexible Office Investment Zones

KL Sentral & Transit-Oriented Developments (TODs)

Best for: Co-Working | Hybrid Office Models

KL Sentral and MRT-connected precincts are ideal for flexible workspace operators.

Why Invest

· High commuter accessibility

· Demand from startups, consultants, and remote teams

· Synergy with hotels and retail components

2026+ Outlook

Flexible offices will increasingly be integrated into mixed-use and transit-centric developments, creating strong long-term demand.

Beyond Kuala Lumpur: Emerging Investment Regions

Johor Bahru (Iskandar Malaysia)

Best for: Commercial Offices | Cross-Border Business

Driven by Singapore spillover demand.

· Competitive pricing

· Strong logistics and industrial linkage

· Growing demand for commercial hubs

Penang (George Town & Bayan Lepas)

Best for: Technology Offices | Business Parks

· Strong electronics and manufacturing ecosystem

· Demand for office-industrial hybrid developments

Putrajaya & Cyberjaya

Best for: Government-Linked Offices | Data-Driven Commercial Assets

· Stable tenancy base

· Rising demand for tech-enabled commercial facilities

2026 Onwards: Key Investment Assumptions

Office Sector

· Grade-A offices outperform

· Older buildings require retrofitting or repositioning

· ESG compliance becomes mandatory for institutional demand

Retail Sector

· Experience-led retail dominates

· Mixed-use integration critical

· Tourism recovery strengthens prime retail zones

Co-Working & Flex Space

· Continued growth driven by hybrid work

· Strong demand in transport-connected locations

· Increasing landlord-operator partnerships

Risks to Watch

· Oversupply in non-prime office locations

· Rising construction and financing costs

· Global economic volatility impacting capital flows

Challenges & Risks

- Supply imbalances: Old office stock is under pressure and may require repurposing or capital investment to avoid obsolescence.

- Cost pressures: Construction and operational costs could slow new supply pipelines and compress margins for developers.

- Interest rate sensitivity: Higher borrowing costs for investors and developers may dampen speculative expansions in some sub-segment

Conclusion: Where Smart Capital Will Flow

From 2026 onwards, Malaysia’s commercial real estate market will reward precision, not speculation. Kuala Lumpur’s prime districts KLCC, TRX, Bangsar, and transit-oriented hubs will remain the safest and most attractive destinations for commercial investment. Meanwhile, suburban retail, flexible offices, and mixed-use developments will deliver the most resilient returns.

Investors who align with location intelligence, sustainability, and evolving work-lifestyle patterns will be best positioned to capture long-term growth in Malaysia’s next commercial property cycle.

Disclaimer

The information contained in this article is published by World Biz Magazine for general informational and educational purposes only. While every effort has been made to ensure the accuracy and reliability of the data, analysis, and opinions presented at the time of publication, the magazine makes no representations or warranties, express or implied, regarding the completeness, accuracy, or future performance of the information contained herein.

This article does not constitute financial, investment, legal, or real estate advice, nor should it be relied upon as such. Market conditions, regulations, and economic factors may change without notice and may impact the accuracy of projections, forecasts, or assumptions discussed.

Readers are strongly advised to conduct independent research and consult with qualified professional advisors before making any investment or business decisions based on the content of this publication. World Biz Magazine, its editors, contributors, and affiliates shall not be held liable for any losses, damages, or claims arising directly or indirectly from the use of, or reliance on, the information provided.

All opinions expressed are those of the authors and do not necessarily reflect the official views of World Biz Magazine.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0